indiana estimated tax payment due dates 2021

Indiana Full-Year Resident 2021 Individual Income Tax Return Form IT-40 State Form 154 R20 9-21 Due April 18 2022 If filing for a fiscal year enter the dates see instructions MMDDYYYY. Estimated Tax Due Dates for Tax Year 2022.

Joyful Giving University Advancement 2020 2021 Annual Report By Indiana State University Issuu

For the 2022 tax year estimated tax payments are due quarterly on the following dates.

. Meat Protein Group sales grew to an increase of. Tax Payment Request Form. New Jersey estimated income tax payment due dates are the same as the federal Form 1040-ES payment due dates.

116th Congress Public Law 94 From the US. State levy is 485 but mandatory 1 local sales tax and 025 county option sales tax are added to the state tax for a 61. Government Publishing Office Page 2533 FURTHER CONSOLIDATED APPROPRIATIONS ACT 2020 Page 133 STAT.

Your state will also have estimated tax payment rules that may differ from the federal rules. Forty-one tax wage and salary income while New Hampshire exclusively taxes dividend and interest income and. Full-time undergraduate in-state Expense type Living on campus Living off campus Living with parent.

Spouses Social Security Number Place X in box if you are married filing separately. Forty-three states levy individual income taxes. You can get health insurance for the rest of the year if you qualify for a Special Enrollment Period due to a life event or estimated income or Medicaid or CHIP.

Individual Income Tax Return electronically using available tax software products. Pennsylvania Consumer Fireworks Tax Due Dates. A calendar year small business corporation begins its first tax year on January 7.

2021 PA Realty Transfer Tax and New Home Construction Brochure. 2022 Pennsylvania Wine Excise Tax Due Dates. Income Tax Deadlines And Due Dates.

2534 Public Law 116-94 116th Congress An Act Making further consolidated appropriations for the fiscal year ending September 30 2020 and for other purposes. 2021 Individual Income Tax Forms. Each calendar year the state income tax due date may differ from the Regular Due Date because of a state.

First monthly estimated payment due Fuel. Supplemental Tax Request Form. Aviation Fuel Excise Tax Return.

To be an S corporation beginning with its first tax year the corporation must file Form 2553 during the period that begins January 7 and ends March 21. Since amounts due for property taxes and insurance may vary year to year the amounts that are collected through the monthly mortgage. The 2-month period ends March 6 and 15 days after that is March 21.

The estimated tax payments are due on a quarterly basis. 2021 CorporatePartnership Income Tax Forms. Additionally Tax Year 2021 Form 1040-NR Amended and Tax Year 2021 Form 1040-SSPR Corrected returns can now be filed electronically.

Find out the most important dates for 2022 health coverage at Healthcaregov. Your Social Security Number. Individual income taxes are a major source of state government revenue accounting for 36 percent of state tax collections in fiscal year 2020 the latest year for which data are available.

In the table below you will find the income tax return due dates by state for the 2021 tax year. A limited time when you can enroll due to a life event like losing other. No prior tax year.

Total Company sales grew 31 to with an Adjusted Earnings Before Interest Taxes Depreciation and Amortization EBITDA i Margin of 62. Cut Along Dotted Line NJ Gross Income Tax Declaration of Estimated Tax NJ-1040-ES 2021 Calendar Year Due JANUARY 18 2022 Social Security Number required - 1 - OFFICIAL USE ONLY Voucher Check 4 if Paid Preparer Filed SpouseCU Partner Social Security Number - - Be sure to include your Social Security number on your check or money order to. Indiana Fiduciary Estimated Tax and Extension Payment Voucher.

ST-103 ST-103CAR ST-103MP CIT-103. And those dates are roughly the same each year the 15th of April June September and the following January. By collecting a portion of the anticipated annual property taxes andor insurance premiums through the monthly mortgage payment.

Utility Receipts Tax Return Calendar Year Filers. If you need to amend your 2019 2020 and 2021 Forms 1040 or 1040-SR you can now file the Form 1040-X Amended US. 2021 Property Tax Rent Rebate Program Information.

We have included the Regular Due Date alongside the 2022 Due Date for each state in the list as a point of reference.

County Income Tax Porter County In Official Website

Indiana Dept Of Revenue Inrevenue Twitter

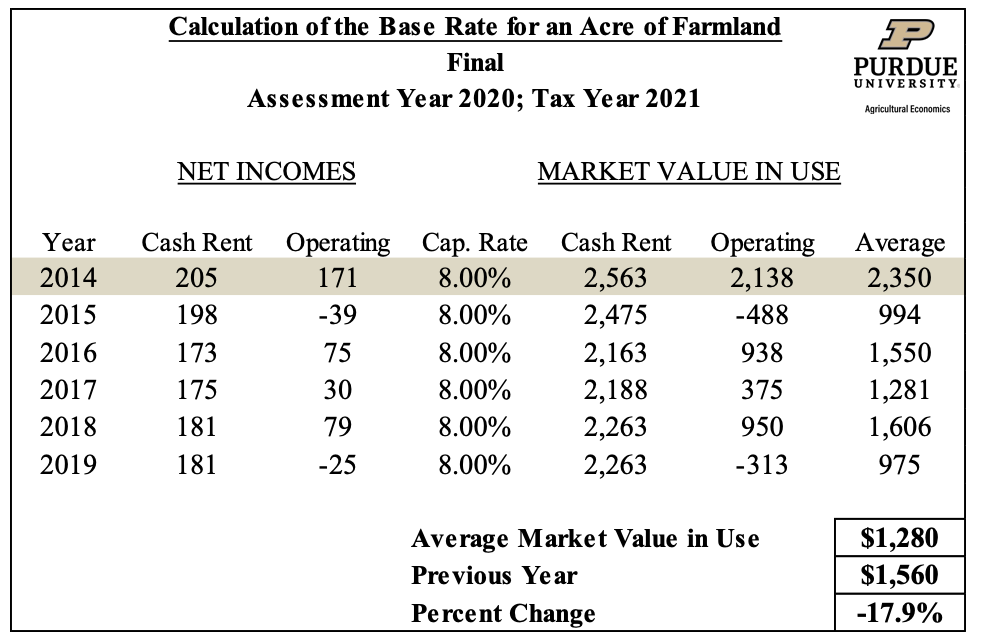

Farmland Assessments Tax Bills Purdue Agricultural Economics

Dor Keep An Eye Out For Estimated Tax Payments

Indiana County Income Taxes Accupay Tax And Payroll Services

Indiana State Tax Information Support

Indiana Sales Tax Filing Due Dates For 2022

Ibj Media Acquires Inside Indiana Business Inside Indiana Business

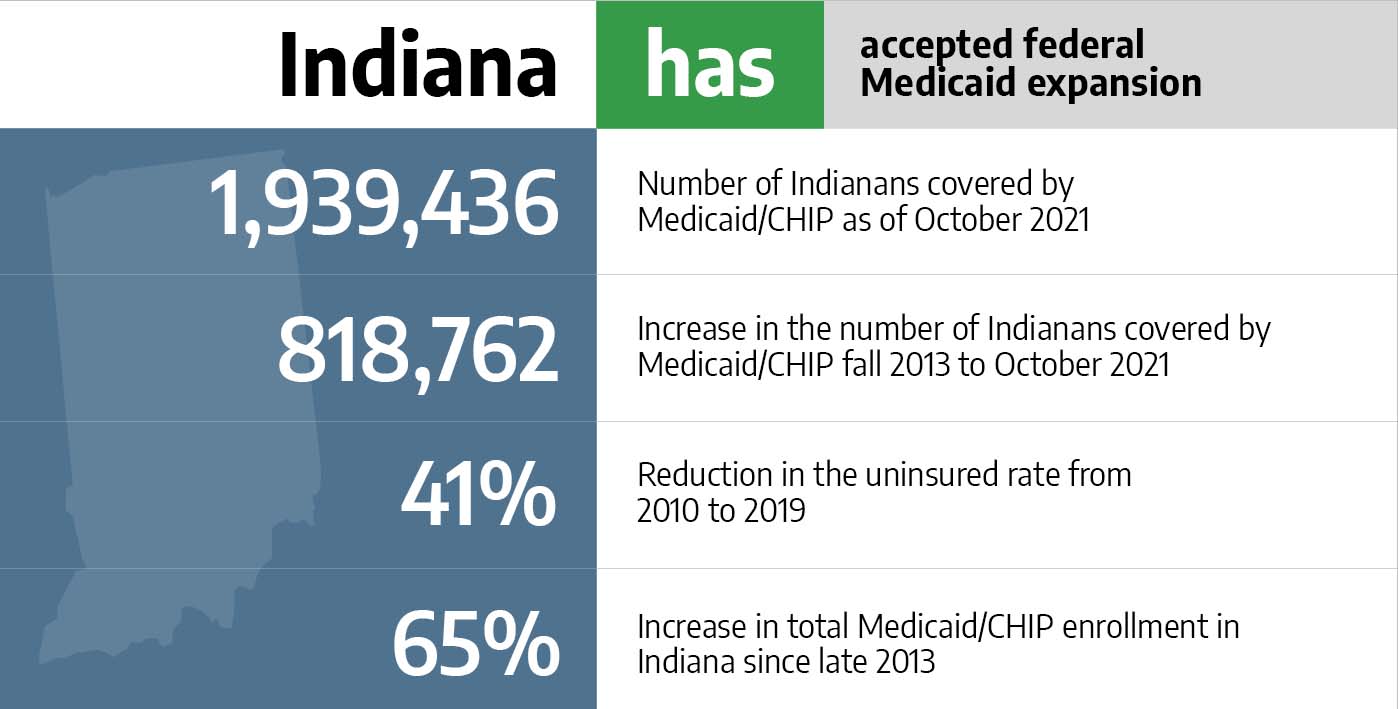

Indiana Health Insurance Marketplace 2022 Guide Healthinsurance Org

Indiana Dept Of Revenue Inrevenue Twitter

Prepare Efile Your Indiana State Tax Return For 2021 In 2022

![]()

Dor 2021 Individual Income Tax Forms

Indiana Model Civil Jury Instructions Lexisnexis Store